I must say, I’m feeling pretty chuffed. But more of that later.

Finally, many are coming to see the folly of a business culture and attendant legislation that puts shareholder primacy front and centre in what has become a financialised economy. We have railed against this for some time, not least in our 2017 paper about corporate governance.

Finally, some kind of momentum seems to be building behind a stakeholder economy. We shall see whether it translates into something real.

As part of this momentum, the Financial Times published an online game. The idea is that you are managing a company and have to allocate resources between four different options: short term results, social benefit, environmental matters, and the long term development of the company. As different events unfold, you are asked to respond. As you make every step of investment, the game gives you the reaction of your investors and other stakeholders.

If you lose either the support of your investors or of your other stakeholders, you lose the game.

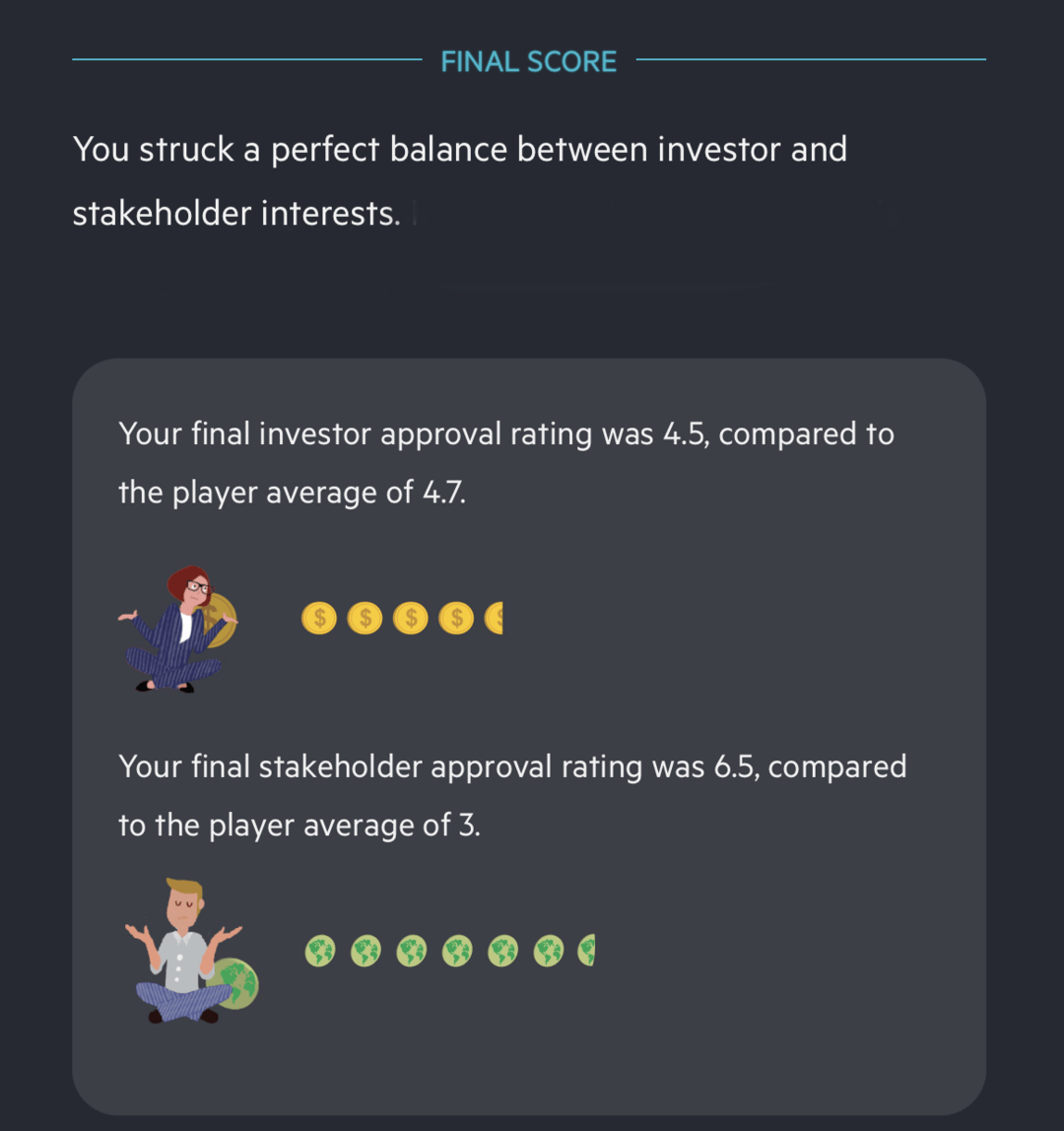

Here are my results. The first image below shows where I ended up relative to other players. It seems that, while I managed to keep investors about as happy as everyone else, I have delighted stakeholders more than the average.

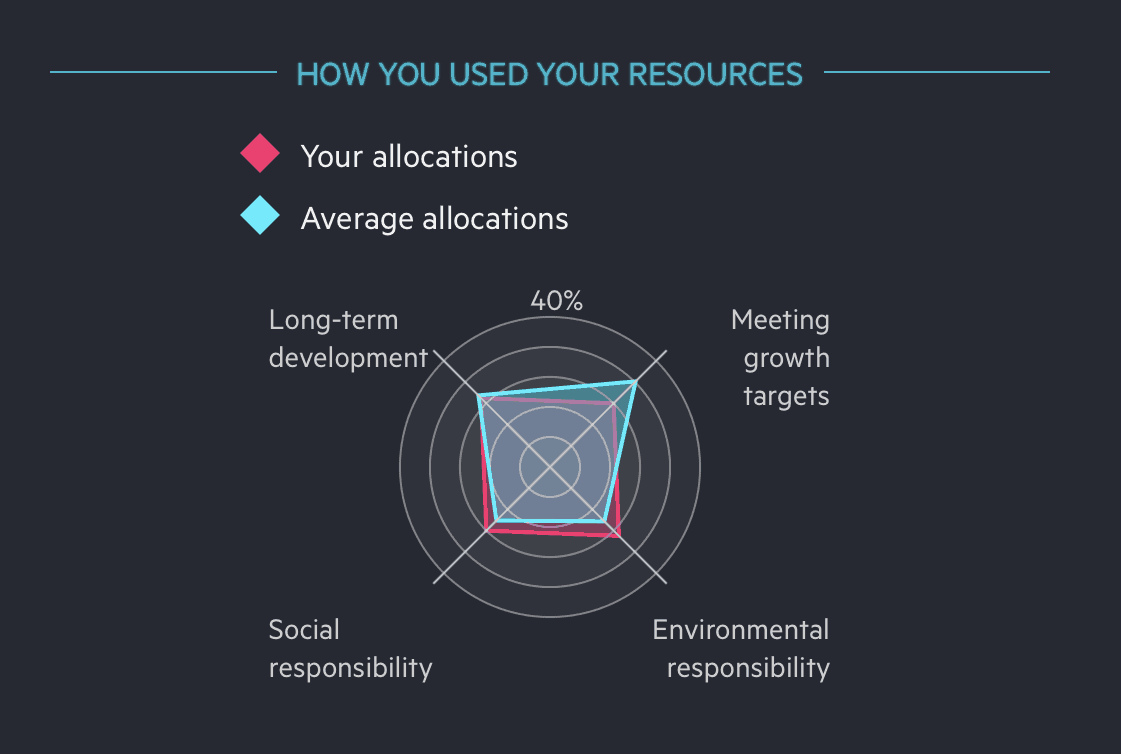

The second image shows how my investments stacked up relative to other players. It seems that I managed to ‘steal’ resources from managing short term growth targets and re-direct them to social and environmental issues without losing investor support.

If I say so myself, I think that’s a pretty good result. Hence why I’m chuffed (it doesn’t take much!). My confession is that I only managed to achieve these results after the second go at the game. My initial results were pretty similar to everyone else’s.

What did I do second time round?

I spent resources on managing short term growth targets early on in the game. As investors gained confidence, I progressively switched more and more resources to long-term plans, social and environmental issues and reduced significantly those resources targeted at short term results.

It seems to me that this is a pretty realistic way of managing a business. One has to build investor confidence first. It’s no good promising jam tomorrow when you still have not proven yourself. But once you have, then investors are likely to trust you more and will accept less focus on the short term and more on other things.

We have seen this, for instance, with companies like Amazon and Virgin that managed to build strong, durable businesses without delivering many short term results.

Now, playing a simple (and somewhat simplistic) online game is somewhat different from actually running a business. But I suggest that the principles still hold. And I was doing this for nothing – just for my own amusement.

Surely CEOs who command tens of millions of dollars in annual compensation have enough about them to do all this is real life. There need be no trade-off between satisfying investors and doing the right thing with a business.

The only things lacking are the will to do it and the mindset that allows it to be done. CEOs who don’t manage it certainly do not deserve their inflated pay packets. And maybe they don’t deserve to be holding their job at all.

There is one flaw. The FT labelled is game “Purpose vs Profit”. In fact, there needs to be no conflict between the two.

This is fascinating Joe. It chimes with work I did a decade ago on what constitutes “good performance” (Theories of Performance, Oxford University Press, 2010).

My focus was on public agencies, but it inevitably involved reviewing broader thinking about performance in the private and public sectors. When I was writing the bubble of ‘shareholder value’ (which usually meant short-term shareholder value) was just starting to be punctured. But over the past decade there is not much sign it has deflated significantly yet?

One of the schools of thought that have most influenced my thinking over the past 3 decades is something called the “competing values” approach, pioneered by Bob Quinn and Kim Cameron. Their basic idea is that all organisations (and people) have conflicting aims and values and the balance between them needs to change at different stages and in different contexts.

They argue that the most successful organisations and individuals are able to adapt appropriately and apply the correct values in the right circumstances. Mediocre organisations and people tend to pick one approach (or aims or values) and stick to it, even when it is are not working. And the worst performers are those who flexibly pick the wrong values for the circumstances.

Thanks Colin

Many senior managers seem to feel that a focus on shareholder value above all else makes their life easier as they don’t have to bother with the trade offs. My view is that life is not like that and, as you say, trade-offs are inevitable and make organisations stronger if they can get them right.

The good news is that the shareholder primacy argument seems to be heading for oblivion – albeit slowly.