What problems might arise from tethering the value of money to an essential sustainable service of nature in each host bioregion of the planet? This basis for establishing a monetary index or tether was suggested in my article “Should money have a stable and predicable value”.

One concern of creating money on a decentralized basis is the possibility of creating too much. This concern can be overcome by only allowing the private issue of money on the condition that it becomes self-liquidating from a negative interest rate.

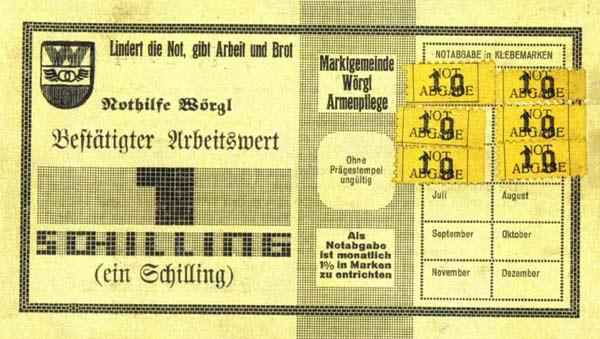

Such self-terminating money was privately issued in Europe and the USA during the Great Depression when it was described as “Stamp Scrip”. Unless a stamp of a specified value was fixed to the back of each note each week, the note did not become redeemable by the issuer. A typical form of Stamp Scrip required a stamp of two percent of the face value to be purchased from the issuer each week and affixed to the back of the note. The issuer undertook to redeem the note for full value at the end of year.

Over a year the income from stamp sales would become 2 per cent by 52 weeks that equalled $1.04. The issuer would make a 4 per cent profit even if the notes were given away as “helicopter” money. Surprisingly the cost to merchants would be reduced.

On 17 February 1933, Senator Bankhead and Congressman Pettingell tabled a Bill in Congress for the US government, not the Federal Reserve Bank (FED), to issue $1,000,000,000 of speed money. As the stamps would be sold by the US post office, the US government would have stimulated the economy without incurring debt or taxes and made a $40,000,000 profit after one year. Instead a New Deal was created two weeks later to keep the FED in existence and lead the US government into an ever-increasing debt trap.

The digitalization of money makes negative interest rate money practical again, as the negative interest rate can be automatically collected through the Internet. Negative interest rate money was also described as “speed” money because it was used first. When the value of such money is also determined by a service of nature, I describe it as ecological money as it also follows the “lose it or use it rule” found in nature including our bodies.

Keynes thought the idea of stamp scrip sound and that its inventor, Silvio Gesell, was an “unduly neglected prophet”. Negative interest rate money stops the use of money as a store of value and so becoming an asset class competing for the allocation of real resources. It also avoids exacerbating inequality by owners of money earning interest when neither the owner nor the money is adding any value to the real economy.

Speed money is again circulating in Germany again without a financial crisis. Arguments for the government issue of helicopter speed money to manage a crisis are presented in my article: “Terminating currency options for distressed economies”.

In a crisis, speed money could be issued tethered to official money to allow both types of money to be used together. But longer-term speed money could become ecological by its value being determined by an index created automatically by the Internet of Things from a “sustainable service of nature”. Renewable energy represents a sustainable service of nature that can generate electricity. The reasons for selecting kilowatt hours of electricity generated from benign renewable sources of energy are presented in my other writings. The objectives of the index would be to:

- Establish a medium of exchange with a stable predicable value.

- Recognise only indirectly over the longer term changes in production, consumption or technology.

- Avoid manipulation by speculators.

- Reduce the cost of the financial system.

- Eliminate a financial crisis in one region spreading to another.

- Eliminate financial instability within each region.

- Eliminate inflation.

- Create incentives for investment in benign renewable energy and storage systems.

- Reduce and/or eliminate the need for carbon taxing or trading.

- Encourage the location and size of the population in each region to become sustainable in perpetuity.

The monetary index for each region of the world would be automatically calculated from the Internet of Things. The IoT would use at least five sets of data from each currency region on a rolling five-year average being:

A= Kwhrs consumed in the region from benign renewable energy sources.

B= Installed Kwhrs capacity of generators using benign renewable energy sources.

C= Kwhrs consumed from non-benign or non-renewable resources.

D= Kwhrs equivalent of energy consumed from non-benign and non-renewable resources.

E= Kwhrs exported from the region produced by benign renewable energy sources.

The importance of objective (ii) is that a financial system is created that accommodates a steady state economy that can provide increasing prosperity and wellbeing, but without growth and even with de-growth. De-growth in the global population is considered by some as essential for establishing a steady state economy in perpetuity.

Help us lay the intellectual foundations for a new radical politics. Sign up to get email notifications about anything new in this blog.

Thanks to David Boyle for posting my article. To allow folk to consider the problems that may arise by each region of the world using its own tether they need to know the basis for its calculation. The objective is to create a tether that will create market forces to encourage the global population to be distributed to regions that can support them in perpetuity and at the same time create market forces to reduce or eliminate the need for carbon taxing or trading to sustain both the environment and humanity on the planet.

Is this possible? One proposal is to change the value of money between regions so the regions that are most efficient in using renewable energy and are most dependent upon using renewable energy obtain money with the greatest value.

Efficient of production is indicated by the ratio of (A+E) ÷ B

Dependency on renewable energy is indicated by the ratio A÷(A+C+D).

The relative value of the Sustainable Energy Dollar (SED=$Z) tether in each region would then be the product of both. That is $Z = (A+E) × A ÷B × (A+C+D).